Reintroducing Funds Is What Stage Of Money Laundering

The idea of money laundering is very important to be understood for these working in the monetary sector. It is a course of by which dirty money is converted into clean cash. The sources of the cash in precise are criminal and the money is invested in a approach that makes it seem like clean cash and hide the id of the felony a part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the brand new prospects or maintaining current customers the duty of adopting enough measures lie on each one who is part of the organization. The identification of such component at first is easy to cope with instead realizing and encountering such conditions in a while within the transaction stage. The central financial institution in any nation offers full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to deter such conditions.

- Finally the third phase in money-laundering once these funds appear to have a legitimate origin consists of reintroducing the funds into the legal economy - through consumption of luxury items since the goal of profitable criminal activity is first to be able to burn the ill-gotten funds. And b it places the money into the legitimate financial system.

What Are The Stages Of Money Laundering Process The Money Laundering Cycle Can Be Broken Down Into Three Distinct Stages

The initial stage of the money laundering process involves moving money from its source and putting it into circulation.

Reintroducing funds is what stage of money laundering. Placement layering and integration. Moving the funds from direct association with the crime Layering ie. Placement the initial entry of funds into the financial system serves the purpose of relieving the holder of large amounts of actual cash and positioning these funds in the financial system for the next stage.

After placing and layering the cash into the financial system the funds become integrated. Generally this stage serves two purposes. It not only distorted the system but also encouraged other crimes.

This involves the process to get the funds back to the criminal from what seems to be a reputable source. This is the final stage of the money laundering process. To ensure you understand the stages of money laundering lets delve into the most frequently asked questions about what money laundering is the three stages of money laundering and what to do if you have been accused of money laundering.

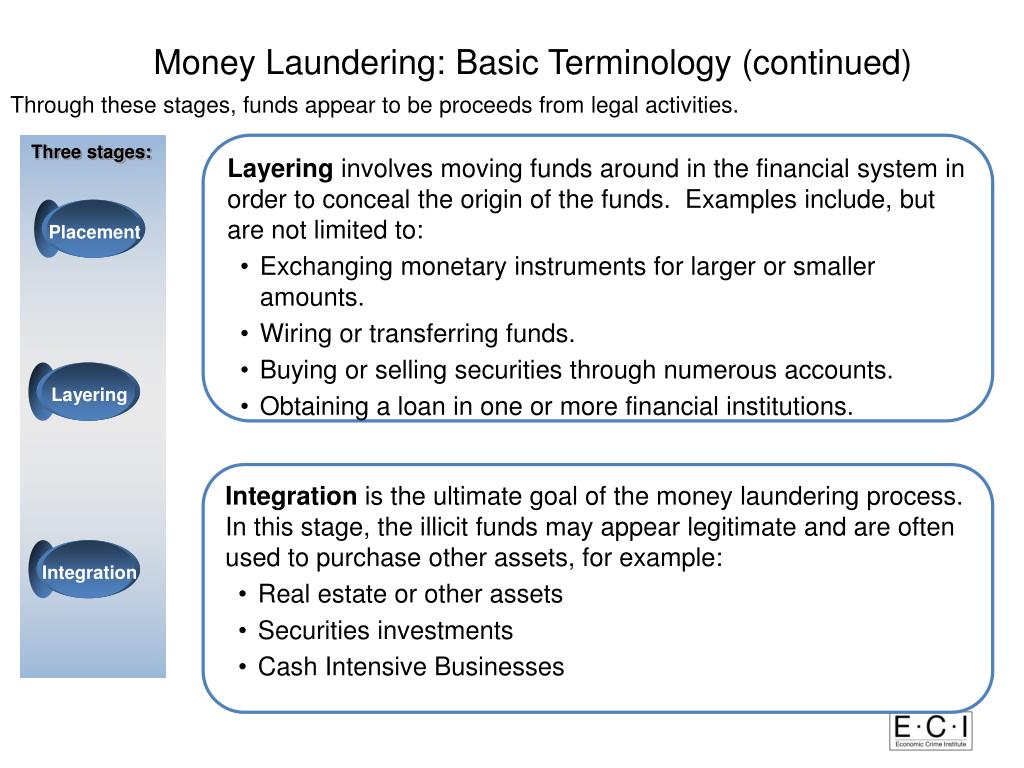

Layering the next stage describes a series of transactions designed to conceal the moneys origin. Placement This is the movement of cash from its source. The layering stage is the most complex and often entails the international movement of the funds.

Money laundering is one of the most common forms of organised crime in the UK. The stages of money laundering include the. The criminal proceeds are deposited into the financial system usually through a financial institution by depositing cash into a bank account.

Integration stage is the final stage of money laundering in which the money is now returned to the criminals legitimately after it has been placed in the financial system often breaking it into different multiple smaller financial transactions. There are three stages involved in money laundering. 3 Stages of Money Laundering.

Money laundering has three main stages and these are. Money Laundering It is a process in which illegal funds are shielded broken the link with the original source given a new legitimate one. A it relieves the criminal of holding and guarding large amounts of bulky of cash.

Money laundering is a process which typically follows three stages to finally release laundered funds into the legal financial system. This is done by the sophisticated layering of financial transactions that. It is during the placement.

Dirty funds are criminally-derived proceeds which are then converted into other assets so that they can be reintroduced into legitimate commerce in order to conceal their true origin or ownership clean funds There are three stages in money laundering. After sufficient time in the layering process criminals can extract their funds and reintroduce them to the financial system as legitimate money. Here the illicit money is separated from its source.

Simply black money is converted into white or illicit proceedings are legalized in this practice Among all financial crimes AML compliance is considered to have the highest intensity. While money laundering is a single process it does have three stages. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

Disguising the trail to foil pursuit. This stage of the process is known as integration. The Layering Stage Camouflage.

What Are The Stages Of Money Laundering Process The Money Laundering Cycle Can Be Broken Down Into Three Distinct Stages

Anti Money Laundering Bribery Awareness Ppt Download

The Phases Of Money Laundering Download Scientific Diagram

3 Stages Of Money Laundering Placement Accordingly The First Stage Of The Money Laundering Process Is Known As Placement

What Are The Stages Of Money Laundering Process The Money Laundering Cycle Can Be Broken Down Into Three Distinct Stages

The Phases Of Money Laundering Download Scientific Diagram

Money Laundering Eumcc Monetary Control Commission

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

The Stage Of Money Laundering At Which Money Is Dispersed And Disguised Money Laundering Defined And Explained With Examples

Understanding Money Laundering European Institute Of Management And Finance

What Is Money Laundering How Does It Occur What Are The Development Impacts Of Money Laundering Emiko Todoroki The World Bank Building Financial Market Ppt Download

What Are The Stages Of Money Laundering Process The Money Laundering Cycle Can Be Broken Down Into Three Distinct Stages

The world of rules can look like a bowl of alphabet soup at occasions. US money laundering rules are not any exception. We've got compiled a listing of the highest ten cash laundering acronyms and their definitions. TMP Risk is consulting agency centered on protecting financial services by reducing danger, fraud and losses. We've got huge bank expertise in operational and regulatory risk. We've a strong background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many antagonistic penalties to the group due to the risks it presents. It will increase the probability of major risks and the chance value of the bank and ultimately causes the bank to face losses.

Comments

Post a Comment